-

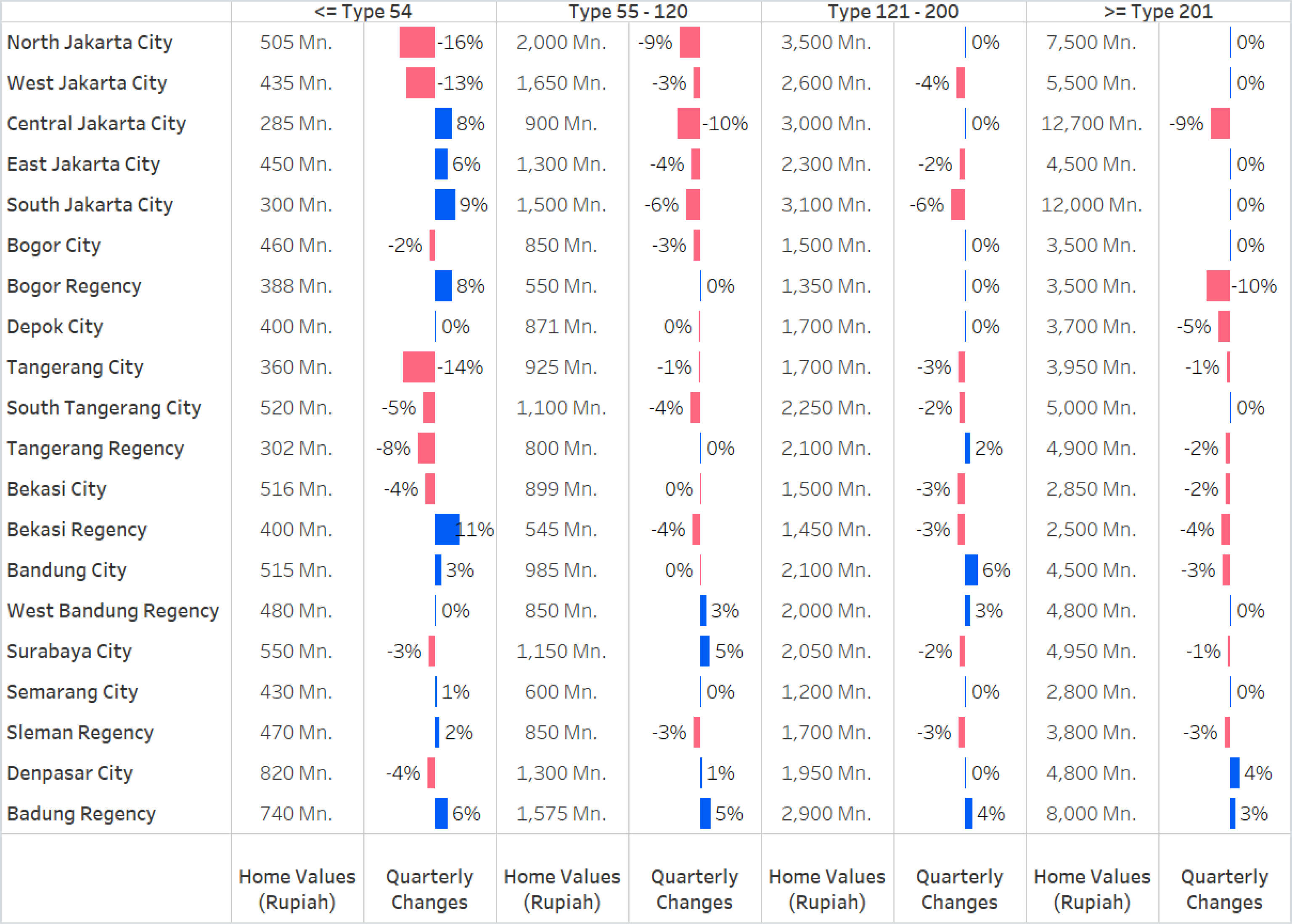

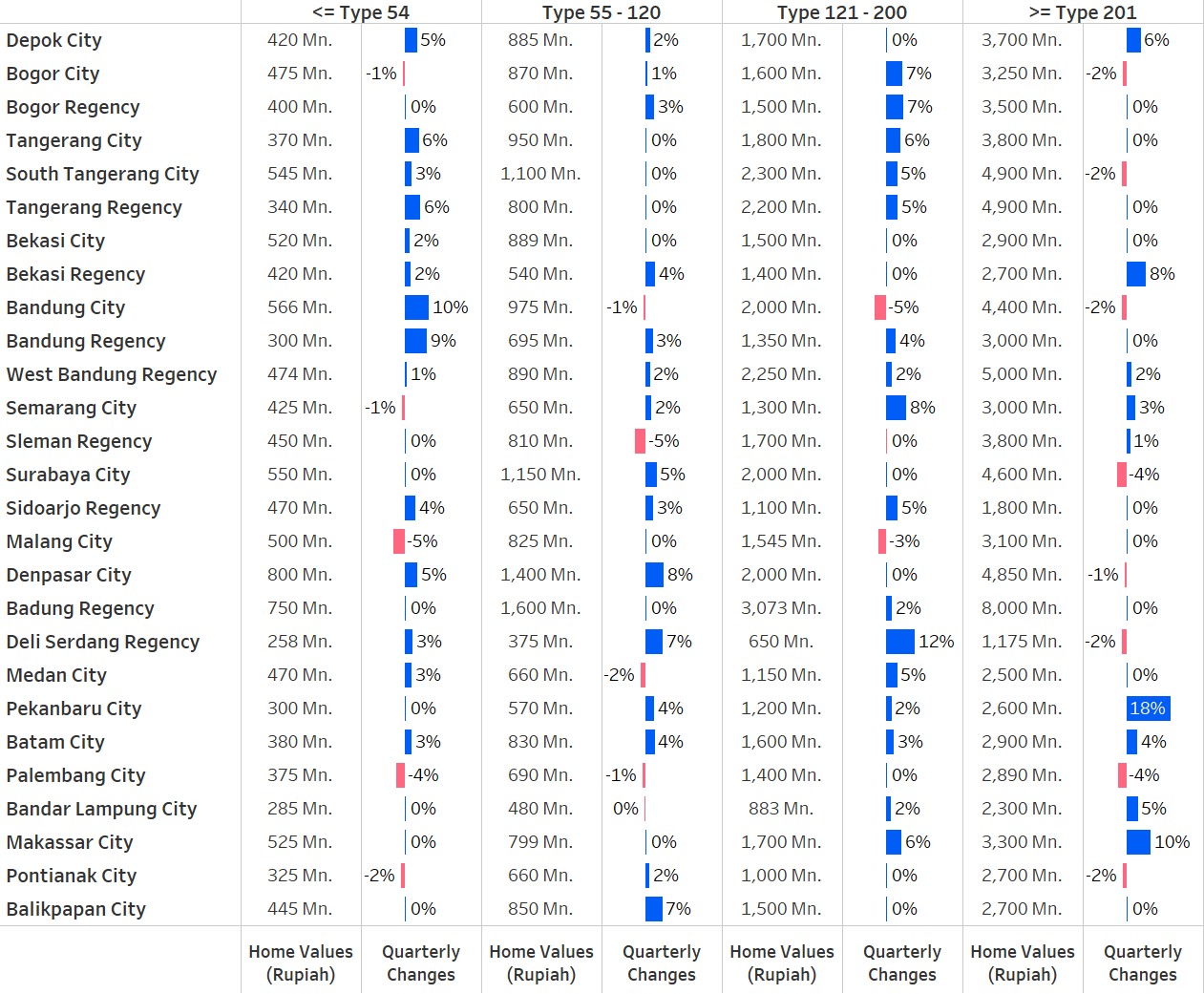

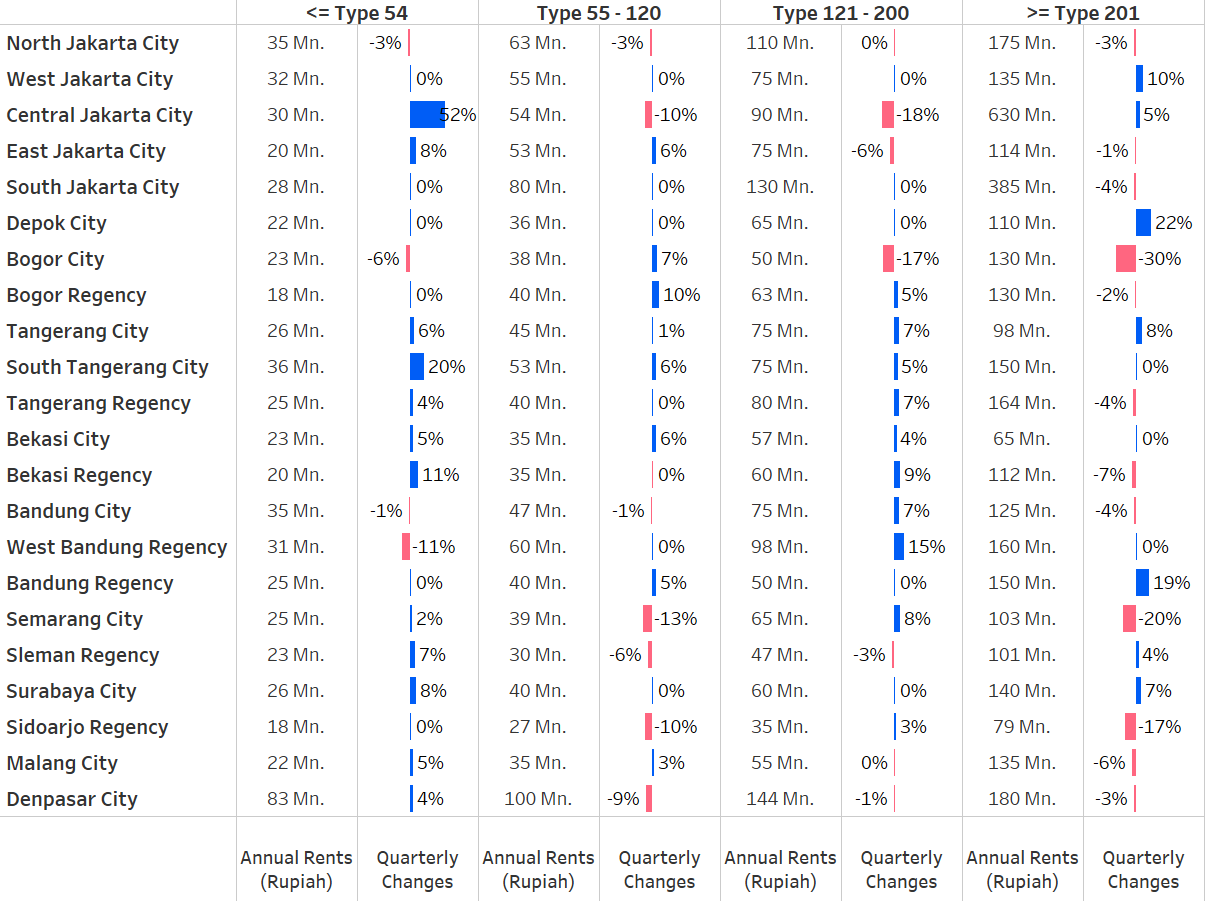

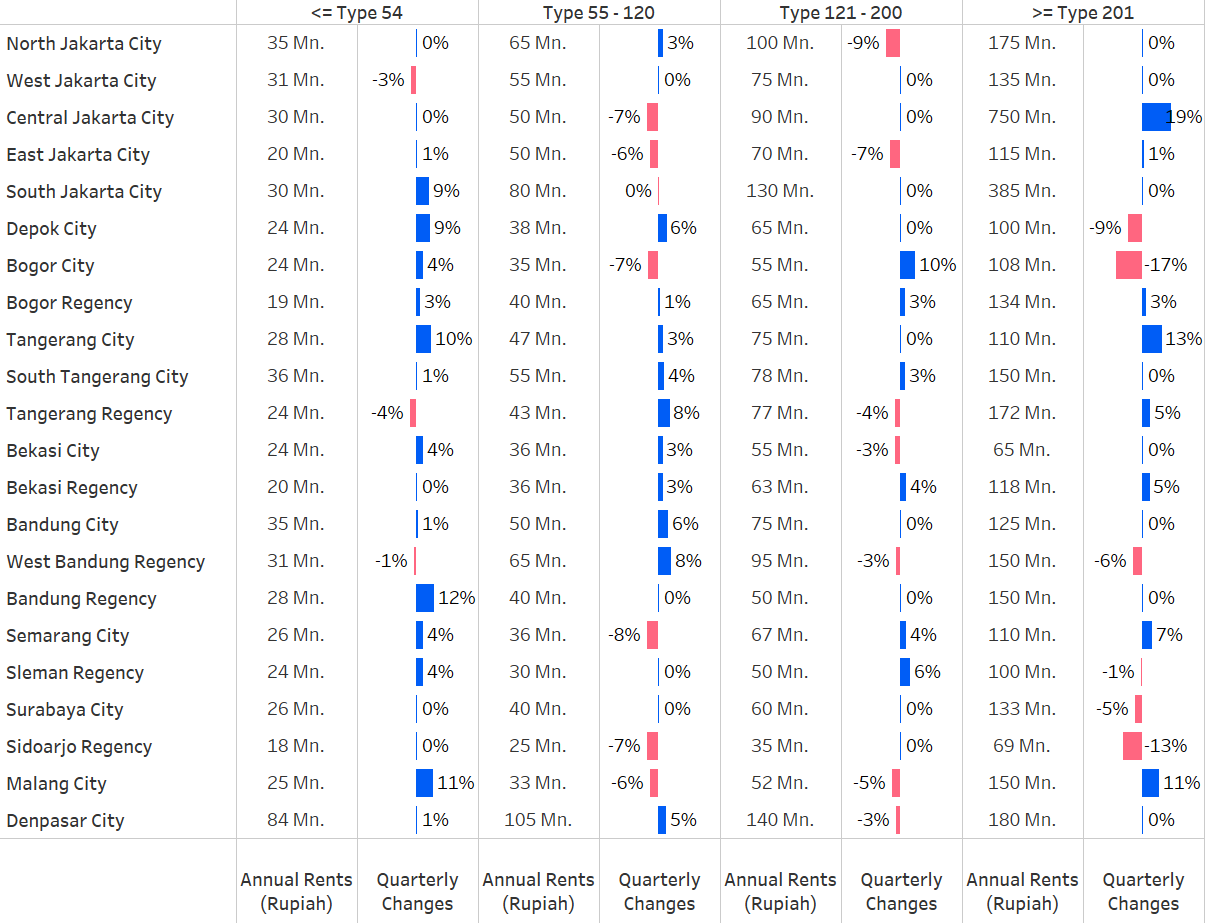

Home values for homes that are less than or equal to type 54 in size have the highest quarterly increases in Bekasi Regency (11%), South Jakarta City (9%), Central Jakarta City (8%), and Bogor City (8%).

-

Homes that are less than or equal to type 54 experienced the highest quarterly changes of home values in North Jakarta City(-16%), West Jakarta City(-13%), and Tangerang City (-14%).

-

Home values for homes with types 55 - 120 generally fell on a quarterly basis in the Jabodetabek area. The biggest changes occurred in Central Jakarta City (-10%), North Jakarta City (-9%), and South Jakarta City (-6%).

-

On the other hand, home values for homes with types 55 - 120 are increasing quarterly outside the Jabodetabek area, particularly in Badung Regency (5%), Surabaya City (5%), and West Bandung Regency (3%).

-

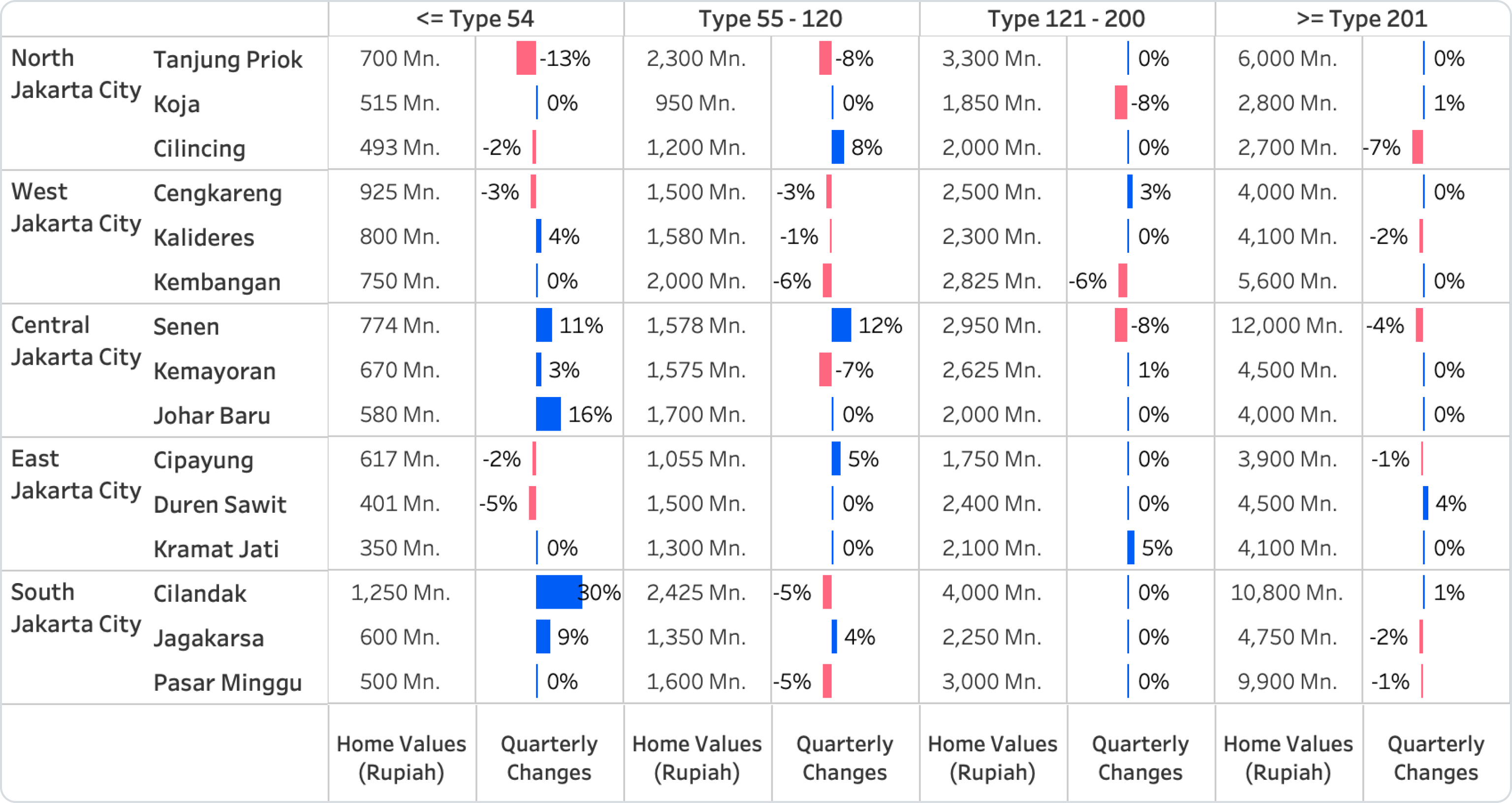

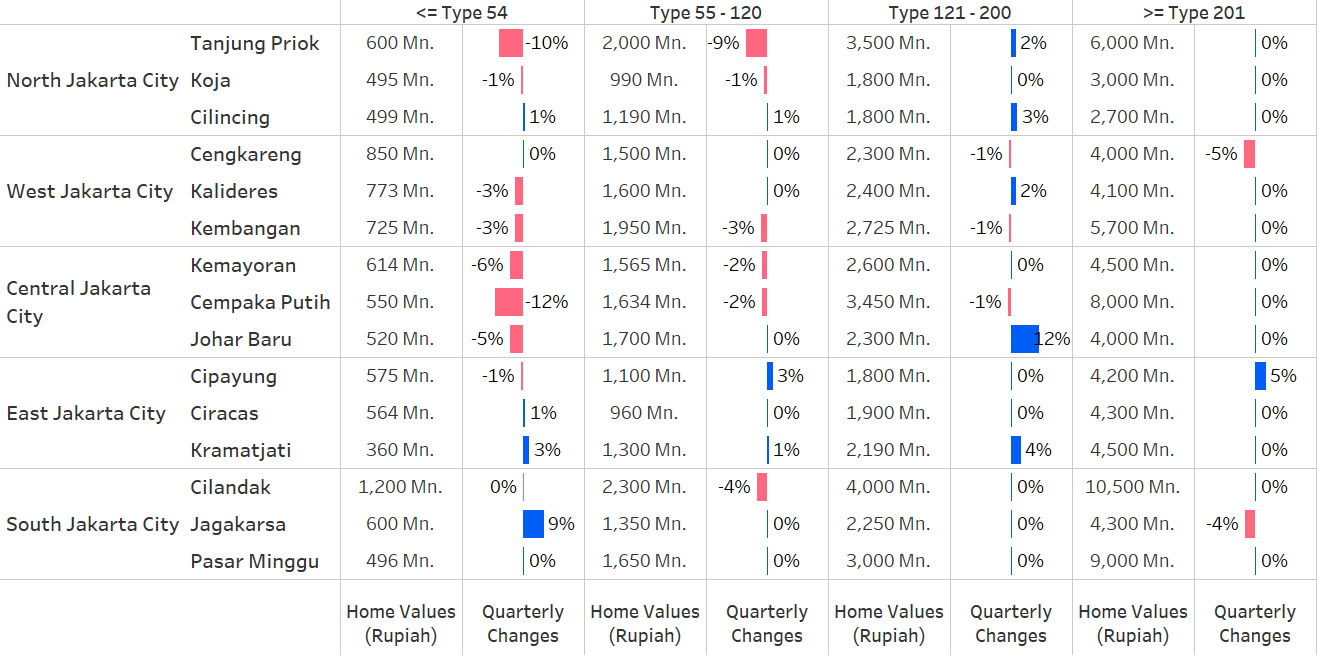

The residential property market in selected districts across Jakarta shows varied patterns depending on house size types. For house with type <= 54, price increases were only seen in Central Jakarta: Cempaka Putih (2%) and Johar Baru (4%), while most other districts remained stable quarterly or experienced declines of up to -6%. A similar trend occurred for type 55-120 houses, where only Tanjung Priok, North Jakarta (5%) and Cakung, East Jakarta (3%) recorded positive growth.

-

Meanwhile, for type 121-200 houses in selected districts of Jakarta, prices tended to remain stable compared to other house type categories. Type 121–200 houses, which typically offer two-story buildings, 3–4 bedrooms, and garages/carports that can accommodate up to two cars, are a suitable choice for families that are growing larger.

-

For the largest house type (type >= 201), price declines only occurred in a few districts. Areas like Cilandak and Kelapa Gading, with selling prices above IDR 6 billion, continued to show positive growth.

-

The following districts offer type 121-200 houses at more affordable prices than type 55–120 houses in neighboring, more developed districts:

-

In North Jakarta, the price of type 121–200 houses in Cilincing (IDR 1.7 billion) is more affordable than type 55–120 houses in Kelapa Gading (IDR 1.975 billion). Cilincing, which is adjacent to Kelapa Gading and also has equivalent public facilities, makes it an alternative for families seeking larger homes while remaining close to public amenities.

-

Meanwhile, South Jakarta, with its commercial business centers, educational facilities, and adequate healthcare services, offers type 121–200 houses in Jagakarsa (IDR 2.25 billion) at a more affordable price than type 55–120 houses in Cilandak (IDR 2.3 billion). The combination of lower prices, sufficient living space, and strategic location makes Jagakarsa a fitting alternative for expanding families.

-

-

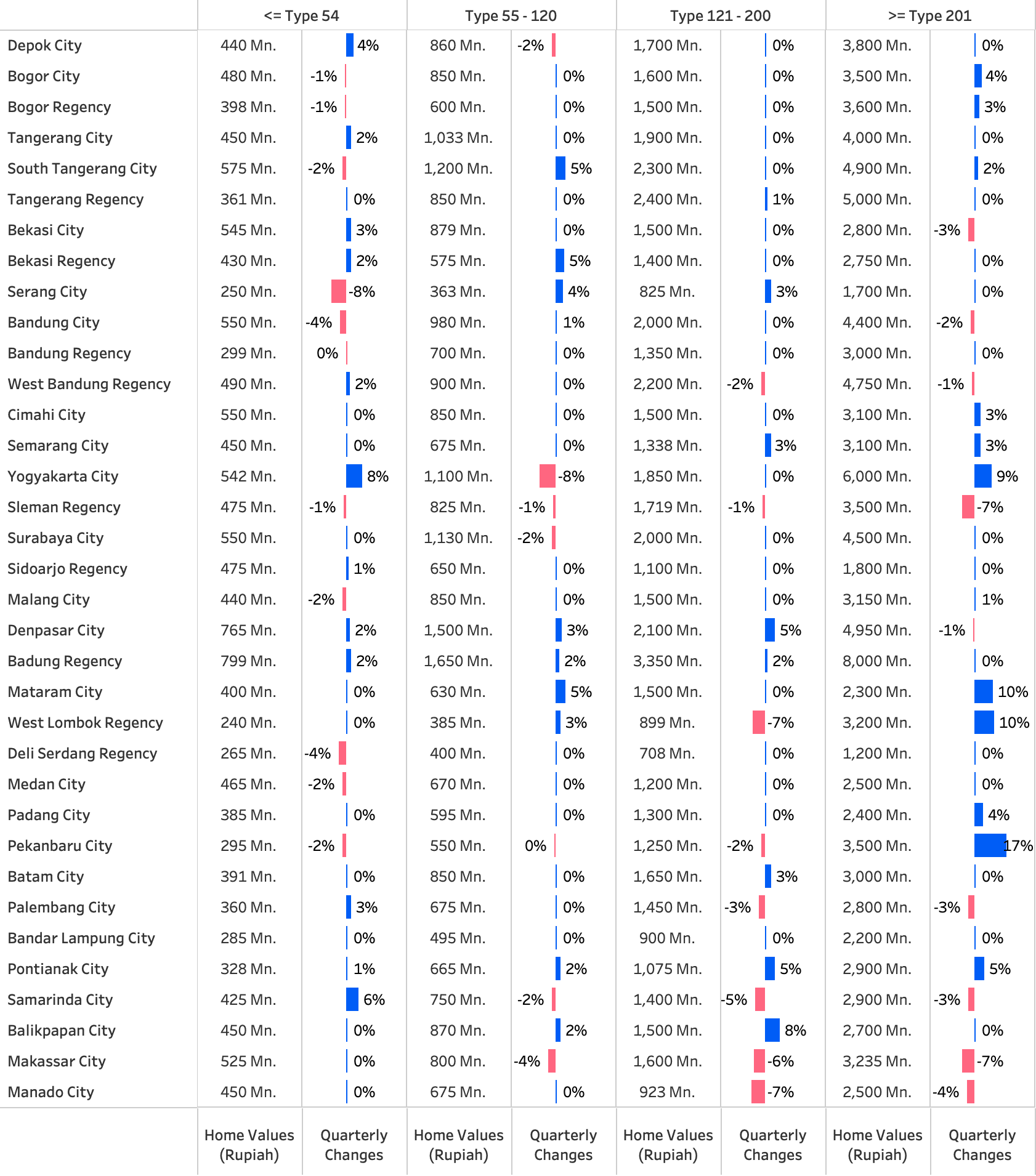

Selling prices for type 121–200 houses in Jabodebek showed no shift compared to the previous quarter, remaining in the IDR 1.4–1.7 billion range—equivalent to the price range of type 55–120 houses in selected districts of Jakarta.

-

Greater Bekasi stands out as an affordable option, with prices 17% lower than Depok. Beyond affordability, Bekasi also offers attractive investment opportunities, supported by a 15% quarterly surge in rental prices for houses with type >= 201 in Kota Bekasi.

-

Bogor City also saw rental price increases of 9% for type 121–200 houses and 12% for type >= 201 houses, positioning it as an alternative to Bekasi for property investors.

-

-

House prices in Tangerang Raya remained stable, though price growth slowed to a range of -2% to 5% quarterly, lower than the increases seen in the previous two quarters. However, type 55-120 houses in South Tangerang still grew by 5%. This growth is driven by large-scale expansions by major developers, who continue to build new residential and commercial areas, reinforcing the region’s appeal as both a livable location and investment hub. This makes it an ideal choice for families prioritizing comfort for children, while for investors, the steady price growth since last year solidifies Tangerang’s position as a long-term appreciating asset.

-

Sleman Regency saw a decline in house prices across all types, with the steepest correction (-7%) for type >= 201 houses. However, as a key education hub in Yogyakarta and Central Java, coupled with consistent rental demand, Sleman remains a viable investment alternative amid stable rental prices in the area.

-

In East Java, the selling price of type >= 201 houses in Sidoarjo (IDR 1.8 billion) is more affordable than type 121-200 houses in Surabaya City (IDR 2 billion). Its direct adjacency to Surabaya makes Sidoarjo an ideal choice for large families seeking proximity to the city center at a more accessible price.

-

In Bali and West Nusa Tenggara, prices continued to rise for specific house types:

-

Denpasar City and Badung Regency saw 2%–5% quarterly price increases for type <= 54, 55-120, and 121-200 houses.

-

Meanwhile, Mataram City and West Lombok Regency recorded the highest price growth (10%) for type >= 201 houses.

-

-

In some cities in Sumatra Island, type 55-120 house prices remained unchanged from the previous quarter. However, type >= 201 houses saw price increases: 17% in Pekanbaru and 4% in Padang.

-

In contrast, Sulawesi saw declines across nearly all house types in Manado and Makassar.

-

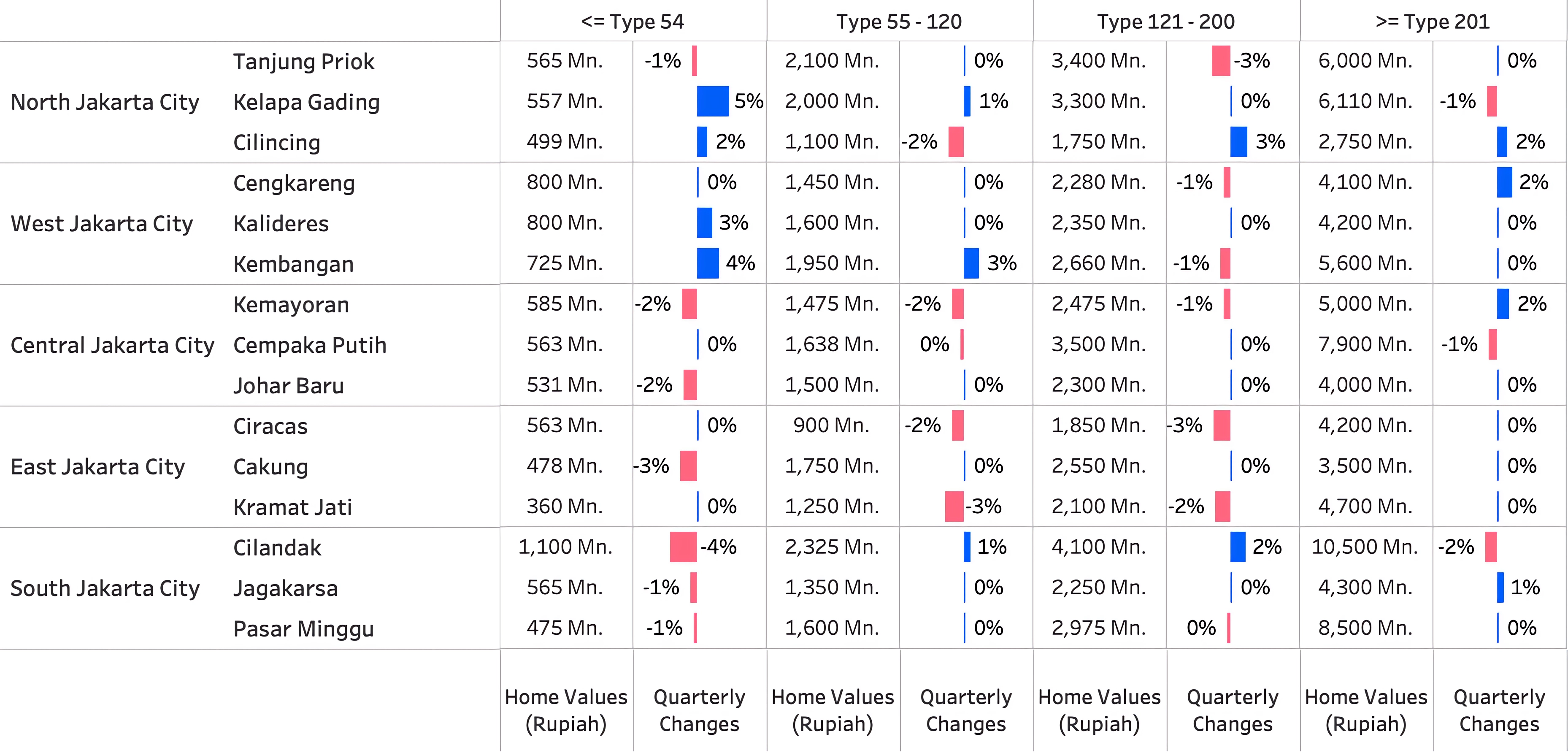

Home values for homes that are less than or equal to type 54 in size have the highest quarterly increases in Tanjung Priok, due to the presence of new listings with more affordable prices in the Warakas Village, Tanjung Priok. Conversely, districts in Central Jakarta and South Jakarta experienced an increase in home values, particularly in Johar Baru, Senen, Cilandak, and Jagakarsa.

-

Home values for homes with types 55 - 120 experienced the most significant quarterly decrease in Kemayoran, Central Jakarta (-7%) and Tanjung Priok, North Jakarta (-8%).

-

Home values for homes with type of 121 or larger tended to experience stable prices on a quarterly basis, with a marginal increases occurring only in homes of type 121-200 in Cengkareng (3%) and Kramat Jati (5%), as well as homes of type 201 or larger in Duren Sawit (4%).

-

Home values for homes in districts of East Jakarta remained stable on a quarterly basis, for types ranging from less than type 54 to larger than type 121.

-

Specifically for homes that are less than or equal to type 54, home values in Cilincing and Kramat Jati are more affordable compared to their surrounding districts. Home values in Cilincing are 40% below those in other districts in North Jakarta. Similarly, home values in Kramat Jati are 30% below those in other districts in East Jakarta.

-

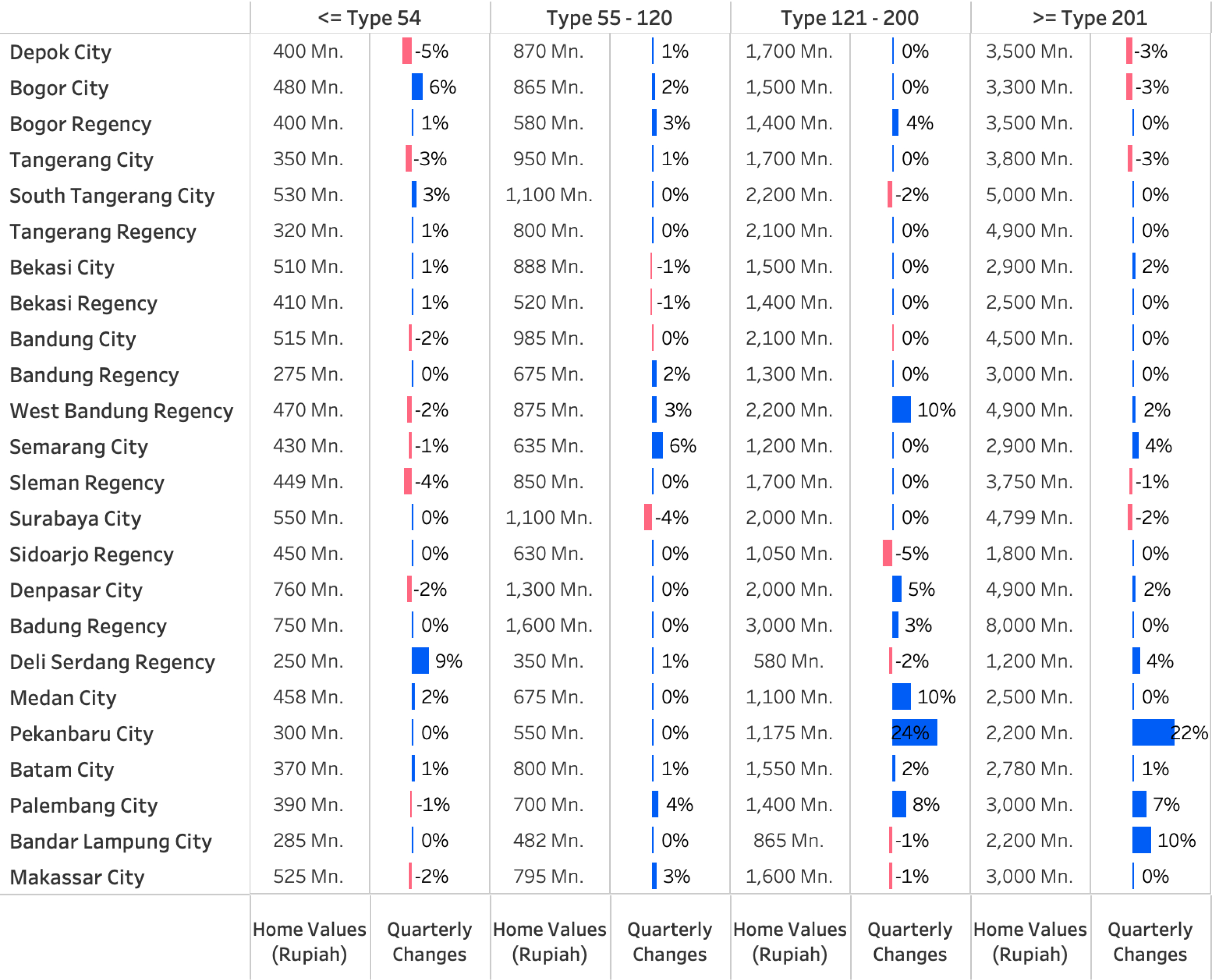

Furthermore, in the areas surrounding Jakarta, home values for homes that are less than or equal to type 54 in size experienced marginal quarterly increases only in Bogor City (6%) and South Tangerang City (3%). Meanwhile, in Depok and Tangerang City, homes with type less than or equal to type 54 are the most recommended choice for first-time home ownership as the home values have decreased by up to -5%.

-

In Bodetabek (Bogor, Depok, Tangerang, and Bekasi), home values for homes in Bekasi (City & Regency) and Tangerang Regency remained stable on a quarterly basis.

-

Home values for home with a type of 55-120 and 121-200 in Bodetabek experienced stable prices on a quarterly basis, with marginal increases occurring in Bogor Regency (3%-4%).

-

Home values for home with type of 55 or larger experienced an increase, with type 12-200 seeing a quarterly increase of 10%. This makes homes in West Bandung an attractive choice for investors seeking property with investment value due to its proximity to high-speed rail transportation.

-

The same applies to home values for homes in Denpasar and Badung Regency, Bali, with an increase occurring for homes with a type of 121 or larger. This makes these areas as alternative options for investors looking to invest in the property sector.

-

Specifically for homes that are less than or equal to type 54 in Depok, home values in Pancoran Mas and Sawangan are more affordable compared to surrounding districts. The same applies in Cileungsi (Bogor), Ciledug (Tangerang), Pondok Aren (South Tangerang), as well as Setu and Tambun Utara (Bekasi).

-

Moving on to the islands of Sumatra and Sulawesi, home values for home in Batam and Makassar experienced stable prices on a quarterly basis for all types of homes.

-

For other cities on the island of Sumatra, home values have increased, particularly for homes with a type of 121 or larger. The most significant increase was led by Pekanbaru, with a quarterly rise of 22%-24%. This indicates a trend of rising property demand in Sumatra, which is impacting the home values.

-

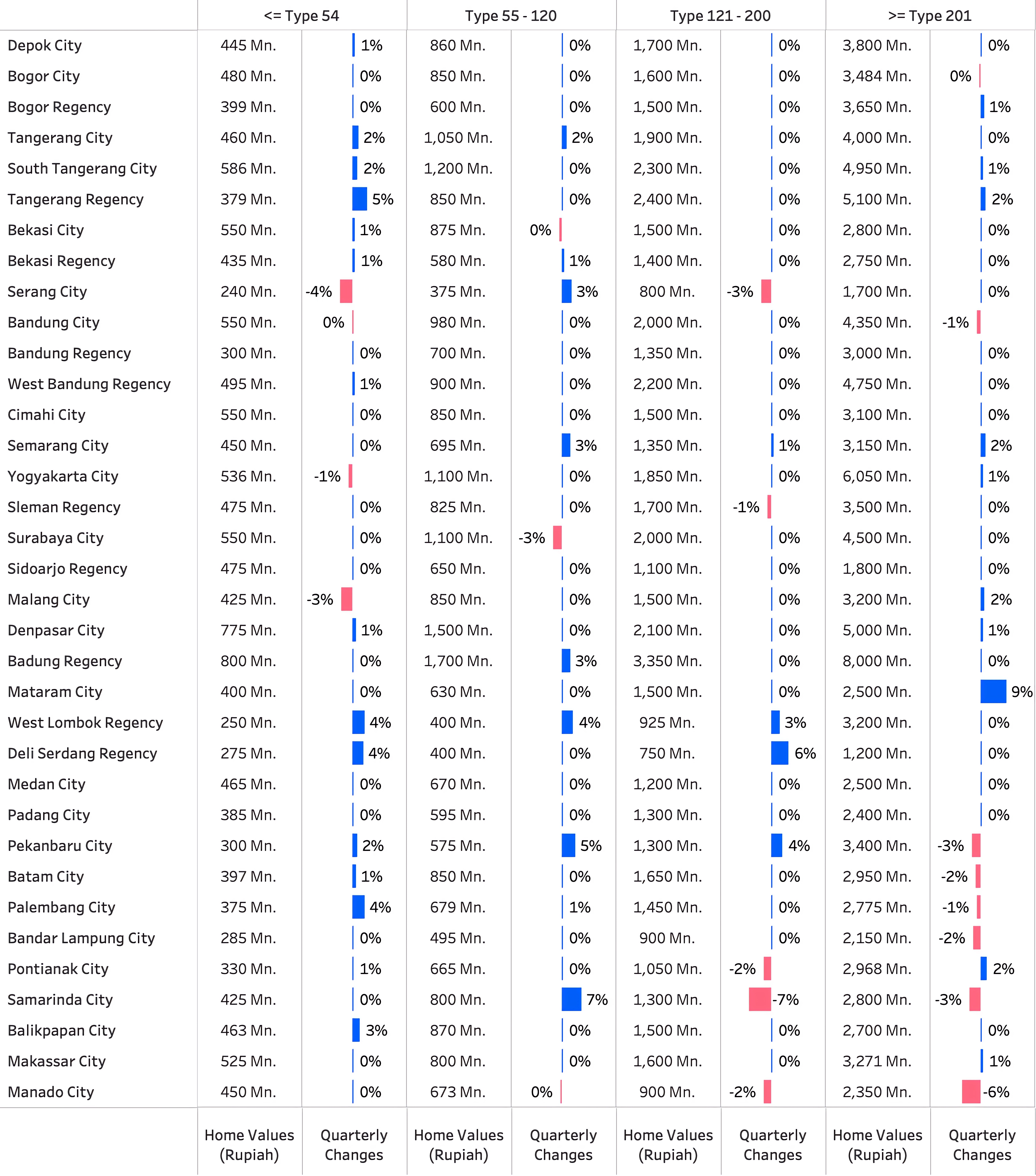

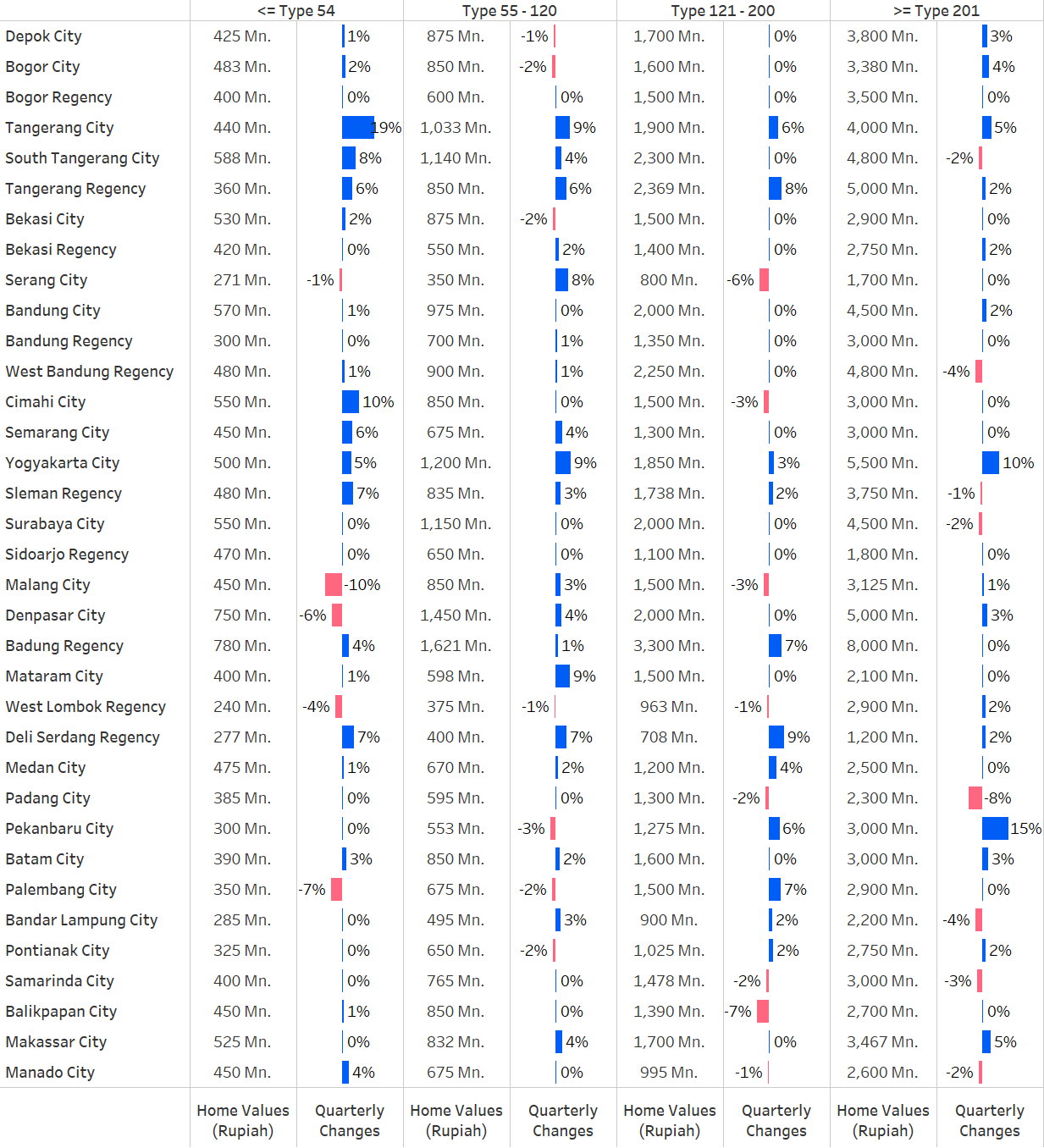

The market for a house with type <= 54 shows a clear divergence between regions

-

In North and West Jakarta, small-type houses experienced quarterly price increases in the range of 2% to 5%, led by Kelapa Gading which surged by +5%. This increase is still related to the strategic toll access of these two regions towards the Tangerang area, as well as their proximity to downtown Jakarta.

-

On the other hand, the regions of Central, East, and South Jakarta experienced a correction instead, with price corrections between -1% to -4%. The sharpest decline was seen in Cilandak (-4%), indicating tight competition from properties in the buffer zones that offer more affordable alternatives.

-

-

For families with 1-2 children looking for an inner-city house with a rational price, East Jakarta now presents an attractive opportunity. Houses with type 55-120 and 121-200, especially in areas like Ciracas and Kramat Jati, experienced a slight price correction of around -2% to -3%. This adjustment is most likely driven by increasing supply and competition, which ultimately benefits buyers by providing more property choices with more competitive prices.

-

Unlike in East Jakarta, the market for houses with type 55-120 and 121-200 in South Jakarta shows solid price stability, indicating a balance between supply and demand in this mature region. Meanwhile, in the North, West, and Central Jakarta regions, their price movement also tends to fluctuate, moving within a reasonable range of between -3% to +3%.

-

The luxury house segment with type >= 201 proves itself to be the most resilient to market dynamics. Although some areas like Kelapa Gading (-1%), Cempaka Putih (-1%), and Cilandak (-2%) recorded a slight decrease, this movement is very marginal. The stability in this segment shows that asset owners in this class have strong financial fundamentals and are in no rush to sell, making this segment a solid store of value amidst market fluctuations.

-

Growth in the regions surrounding Jakarta this quarter is concentrated on the west side, namely Greater Tangerang. On the other hand, the eastern (Greater Bekasi) and southern (Depok and Greater Bogor) regions tend to be stable.

-

The most significant price increase occurred in a house with type <= 54 in Tangerang Regency (+5%). After significant development from well-known developers targeting the middle and luxury house segments, small-type houses followed with growth to complete every demand segment there.

-

As for the middle types as well as those above 201, prices only moved in the range of 0% to 2%.

-

-

The Greater Bandung property market generally shows stability in almost all house types. This indicates that the market is in a wait-and-see phase, likely having absorbed the initial sentiment of the "Whoosh Effect" and is now waiting for the next economic catalyst.

-

Then in Central Java, the selling price of a house also tends to be stable and grow slightly, especially for a house with type 55-120 in Semarang (+3%). This shows market resilience in Central Java and that there are no new catalysts to drive higher price increases.

-

Continuing to East Java, a price decrease is seen for a house with type 55-120 in Surabaya (-3%) and for a house with type <= 54 in Malang City (-3%). This trend points towards an excess of listings in these segments in both cities, thus causing a more competitive price adjustment.

-

The tourism sector in Bali and Lombok remains the main fuel for the growth of house selling prices in these two regions, especially in West Lombok, which rose by 3% to 4% for houses with type <= 54 as well as 55-120 and 121-200. Lombok is increasingly strengthening its position as a favorite location for investors looking for properties with long-term investment value.

-

Meanwhile in Sumatera, after having experienced growth in the house with type >= 201, this quarter it experienced a slight correction, ranging from -1% to -3%. However, overall, houses in the smaller types were still able to remain stable and grow in several cities like Pekanbaru.

-

In line with the continuation of development in IKN, Balikpapan City recorded an increase of +3% for a house with type <= 54 and was stable for larger house types. However, in Samarinda, price volatility occurred in the middle house segment for type 55-120 (+7%) and type 121-200 (-7%), indicating that the high-end buyer segment tends to hold back on purchasing luxury properties.

-

Meanwhile in Manado, a correction occurred for a house with type 121-200 (-2%) and type >= 201 (-6%). On the other side, new development plans by property developers in Manado could be a maneuver for the recovery of the luxury house market in the future.

-

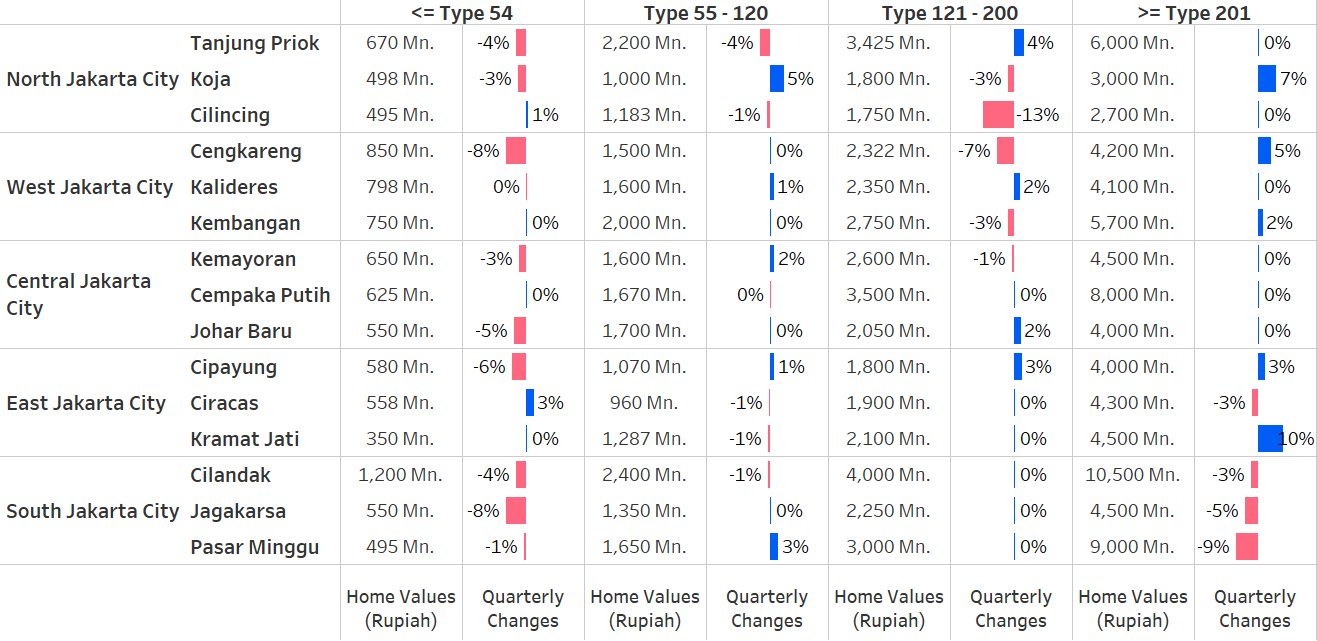

In the third quarter of 2024 for the Jakarta area, house selling prices in these districts have shown stability or a decline across almost all house types

-

In Cengkareng, West Jakarta, house prices for types smaller than or equal to 54 dropped by up to -8%.

-

In Jagakarsa, South Jakarta, competition in the minimalist house segment with motorbike access contributed to a price drop for houses smaller than or equal to 54, with house prices decreasing by up to 50 million rupiah (-8%) compared to the previous quarter.

-

House prices for the type 121-200 in Cilincing, North Jakarta, decreased by up to -13% as houses in Marunda Village and its surroundings have become more affordable than in other areas of Cilincing.

-

-

If we look at house types, in the third quarter of 2024 in Jakarta,

-

Houses smaller than or equal to 120 in Tanjung Priok continued their downward trend from the second quarter of 2024, with house prices dropping by -13% last quarter and by -4% this quarter, particularly for houses smaller than or equal to 54. This is due to the growing supply of type 21 houses with selling prices below 350 million rupiah.

-

Cilincing district, North Jakarta, showed a significant drop (-13%) in the median house selling price for type 121-200, as mentioned earlier.

-

Houses of type 201 or larger experienced a significant decline, reaching -9% in Pasar Minggu, South Jakarta. This decrease was driven by price competition in the luxury housing segment in Kebagusan sub-district, where several luxury houses priced below 9 billion have become increasingly available in the market.

-

-

The decline in house prices for types smaller than or equal to 54 in nearly all selected districts in Jakarta presents an attractive opportunity for first-time homebuyers. Additionally, the planned policy of eliminating house purchase taxes by the president-elect, Prabowo Subianto, could make this a perfect moment for first-time homebuyers to acquire a house at more affordable prices when the policy is implemented.

-

House selling prices in the Jakarta surrounding areas have increased, ranging from houses smaller than or equal to 54 to those larger than 201. The most significant price increase occurred for houses larger than 201 in Bekasi Regency (8%) and for type 121-200 houses in Bogor Regency (7%). The Cimanggis-Cibitung toll road, which began its operations in July 2024, has connected the JORR 2 toll road along 111 km, thereby enhancing mobility, connecting Cimanggis, Depok City, through Bogor Regency, as well Bekasi City and Regency, has implications for the increase in the investment value of homes in the area.

-

In Bandung City and Regency, there has been a surge of up to 10% in house prices for types smaller than or equal to 54. One year since the operation of the high-speed train in October 2023, the consistent price increase in West Bandung Regency reflects the long-term impact of transportation infrastructure on the property market in areas along the route. However, a decline occurred for house types larger than 54 in Bandung City, especially for type 121-200 (-5%) due to decreases concentrated in several eastern districts of Bandung, such as Rancasari, Cibeunying Kaler, and Cibeunying Kidul.

-

In Central and East Java, except for Malang City, house selling prices in each city generally increased for one type of house, with the most significant increase occurring for type 121-200 houses in Semarang (8%) and for houses smaller than or equal to 200 in Sidoarjo and Surabaya (up to 5%). The operational of the Djuanda Flyover, which enhances connectivity and mobility between Surabaya and Sidoarjo, is believed to strongly impact Sidoarjo’s economic growth, stimulating demand and property price increases there. Additionally, the Presidential Instruction on regional road improvements in East Java has significantly impacted infrastructure development in the region. One improvement program includes 11 road sections, one of which passes through Sidoarjo, further enhancing inter-regional accessibility.

-

House prices in Denpasar City and Badung Regency, Bali, have continued their upward trend since Q2 2024, with type 121-200 house prices rising by up to 5% last quarter and increasing again by up to 2% this quarter.

-

Turning to Sumatra and Sulawesi, there has been an increase in house prices in all selected cities except Palembang, led by Deli Serdang Regency, which experienced a 7-12% price increase for type 55-200 houses. In Palembang, house prices have decreased across all types except for type 121-200.

-

In Kalimantan, house prices for type 55-120 in Balikpapan have shown an increase of up to 7%, while in Pontianak, house prices have remained relatively stable across all types.

-

House selling prices in North Jakarta, West Jakarta, and Central Jakarta remain stable or decline in the fourth quarter of 2024 for houses smaller than or equal to 120. A faster increase in inventory compared to demand has led to relatively lower house prices in these areas. Nevertheless, this situation presents an opportunity for prospective property owners looking for more competitively priced houses in Jakarta.

-

In North Jakarta, particularly in Tanjung Priok, house selling prices for houses smaller than or equal to 120 have dropped by up to 10%.

-

Meanwhile, in Cempaka Putih, Central Jakarta, house selling prices have decreased by as much as 12% for the same type of houses.

-

-

Meanwhile in South Jakarta, house selling price have remained stable, with an increase of up to 9% in Jagakarsa for houses. The rise in demand for residential houses in Jagakarsa has led to an increase in the price of house selling prices. Then, for houses larger than or equal to 201, house selling price is stable have remained stable, with declines observed only in Cengkareng, West Jakarta (5%), and Jagakarsa, South Jakarta (4%).

-

Districts in East Jakarta exhibit the most stable house selling prices in the city, reflecting the resilience of the local property market.

-

House selling prices in Tangerang Regency and South Tangerang City have increased across almost all house types, particularly for houses of type smaller than or equal to 54, which recorded an 8% rise in South Tangerang City. This increase is related to the designation of BSD as a Special Economic Zone (SEZ) in October 2024. This status is expected to attract large-scale investments and spur improved infrastructure development in the area. The resulting boost in economic activity will enhance the appeal of the region to property seekers, ultimately driving up house selling prices.

-

Tangerang City also show significant increase in house selling prices, especially for houses smaller than or equal to 54, which have surged by up to 19%.. This increase is largely driven by the ongoing construction of Section 1 of the Kataraja Toll Road (Kamal-Teluknaga-Rajeg-Balaraja, which is expected to become operational in 2025.

-

In other areas around Jakarta, house selling prices across all house types in Bogor, Depok, and Greater Bekasi have remained stable on a quarterly basis.

-

Cimahi City, which borders Bandung City and West Bandung Regency, leads the growth in house selling prices in Greater Bandung, particularly for houses of type smaller than or equal to 54, with a 10% increase. Its proximity to the city and the Padalarang High-Speed Rail Station makes it an attractive option for those looking for a house near Bandung.

-

House selling prices in Yogyakarta City and Sleman Regency also demonstrate positive growth in almost all house types. This increase is closely linked to the ongoing progress of the Solo-Yogyakarta-YIA Kulonprogo Toll Road project. Enhanced transportation access is driving up house prices in the areas surrounding Yogyakarta.

-

Moving on to East Java, house selling prices in Surabaya City and Sidoarjo Regency have remained stable across almost all house types. However, in Malang City, house selling prices, particularly for houses smaller or equal to 54, have continued to decline since the third quarter of 2024, with a -10% drop this quarter due to an increasing supply of subsidized houses in the market.

-

In Denpasar City and Badung Regency, house selling prices tend to rise across almost all house types, except for houses smaller than or equal to 54 in Denpasar City, which have decreased by up to 6%.

-

Meanwhile, in Mataram City and West Lombok Regency, the most significant increase in house selling prices for houses of type 55-120 occured in Mataram City (9%).

-

Moving to Sumatra Island, house selling prices across almost all house types have increased in Medan City and Deli Serdang Regency in North Sumatra Province.

-

On Kalimantan and Sulawesi island, house selling prices for houses smaller than or equal to 120 have remained stable. In contrast, the most significant decrease, up to- 7%, occurred for houses of type 121–200 in Balikpapan City.

-

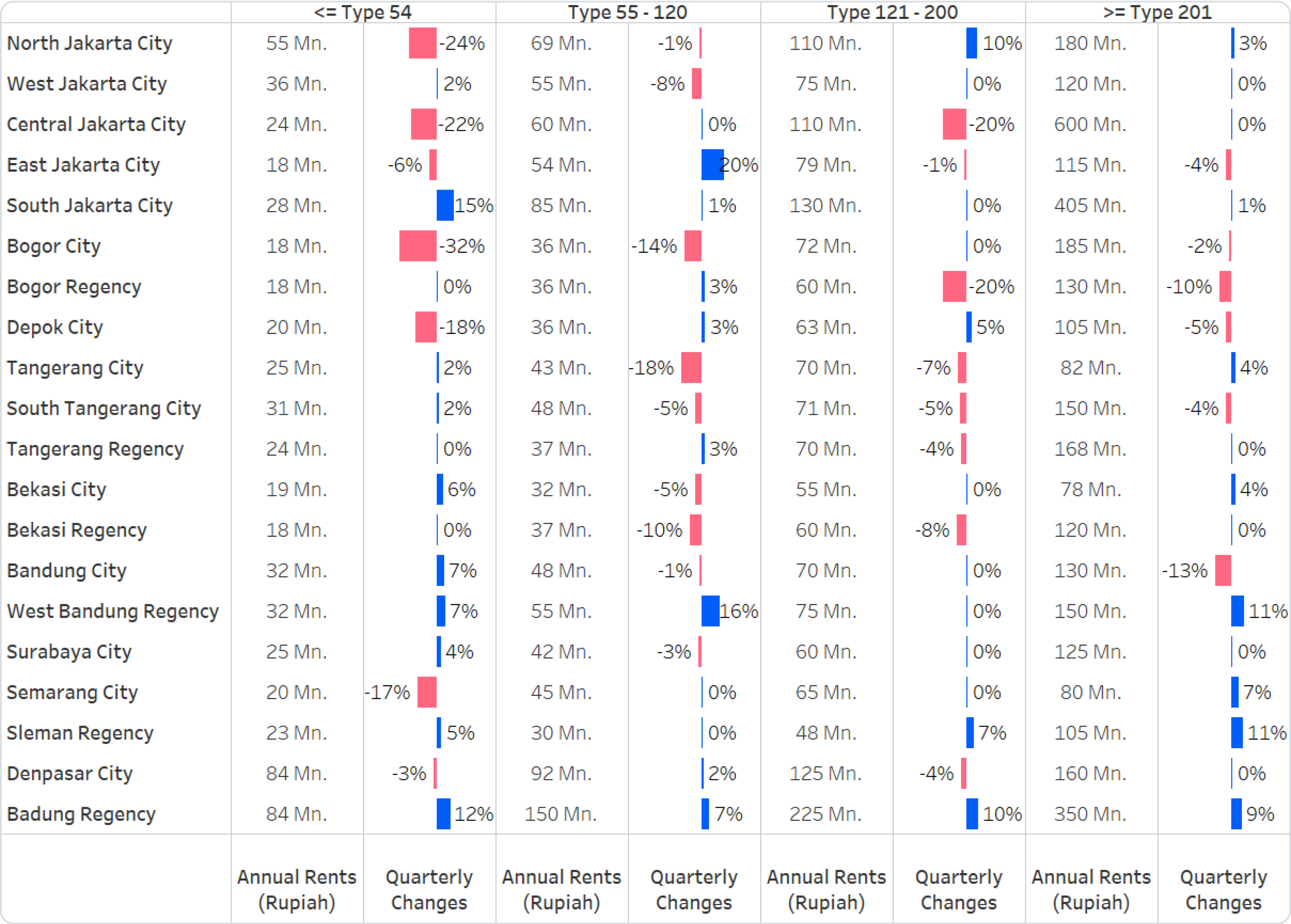

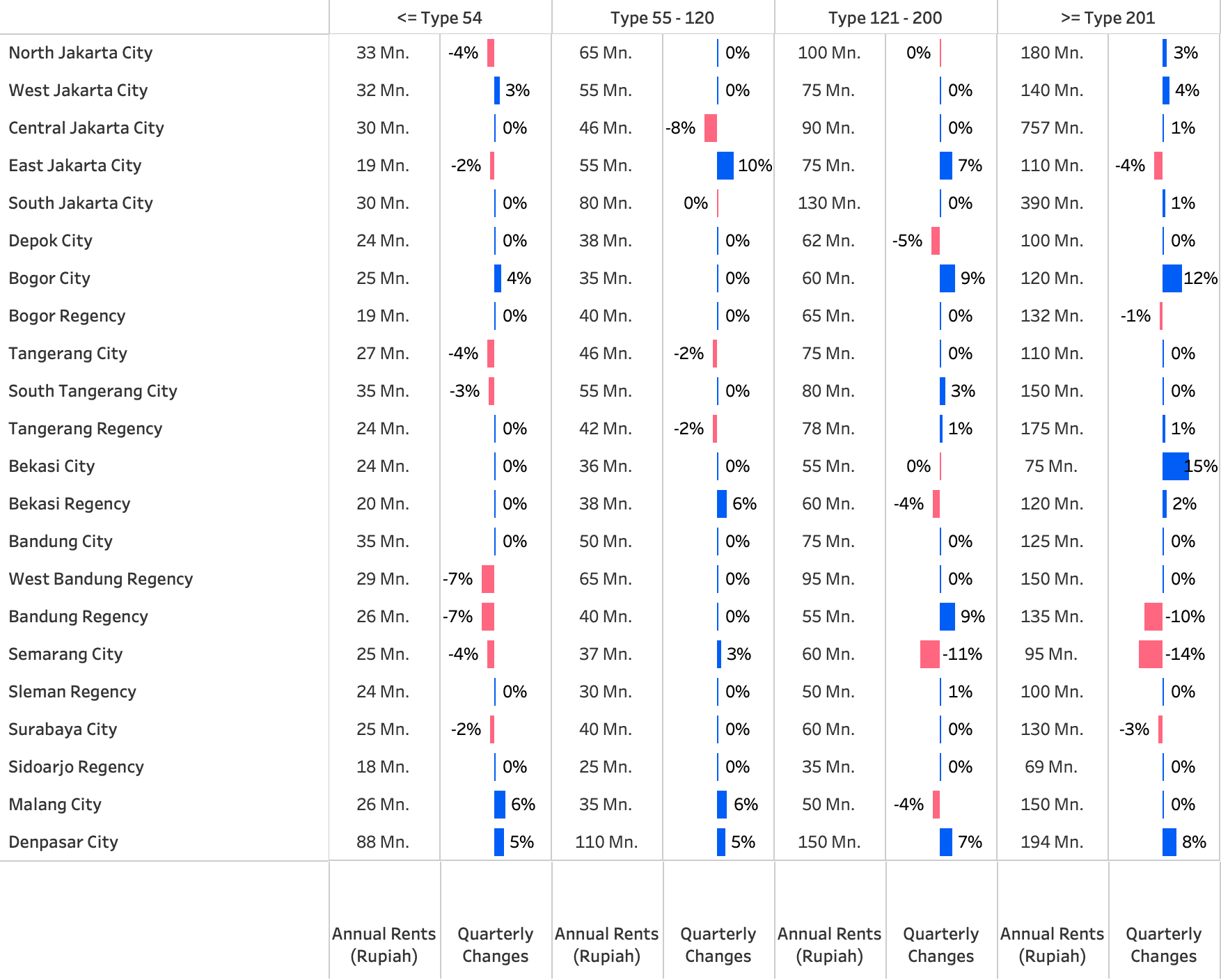

Homes less than or equal to type 54 experience a quarterly increase in annual rent in South Jakarta (15%), Badung Regency (12%), Bandung City (7%), and West Bandung Regency (7%).

-

Annual rent for homes less than or equal to type 54 fell on a quarterly basis in Bogor City, North Jakarta, and Central Jakarta, with changes of -32%, -24%, and -22%, respectively.

-

East Jakarta has the highest quarterly increase in annual rent for homes with types 55 - 120, experiencing a 20% increase. A 16% increase also occurred in West Bandung Regency.

-

Annual rent in cities around DKI Jakarta generally fell on a quarterly basis. The biggest changes occurred in Tangerang City (-18%), Bogor City (-18%), and Bekasi City (-10%).

-

The residential rental market in Jabodetabek also shows different dynamics for each house type. For type <= 54 houses, while most areas remain stable, slight rental price declines of -2% to -4% were observed in North Jakarta, East Jakarta, and Tangerang.

-

For type >= 201 houses, rental prices in Jabodetabek were generally stable, but two cities recorded significant increases: Bekasi and Bogor rose 15% and 12% quarterly, respectively. Aligning with trends mentioned in Pinhome's Home Value Index analysis, these rental price increases serve as catalysts for those targeting houses for subleasing or property owners looking to raise rental rates.

-

For mid-size houses, East Jakarta stands out with 10% rental growth for type 55-120 houses and 7% for type 121-200 houses. Similar to Bekasi, with selling prices in this area remaining among the most stable, it can be an alternative to Bekasi when closer access to Jakarta is needed. Meanwhile, Bogor City also shows positive trends with a 9% increase for type 121-200 houses.

-

In Greater Bandung, particularly in Bandung Regency and West Bandung Regency, rental prices for type <= 54 and type >= 201 houses decreased by more than -7% quarterly, indicating market stagnation after previous quarters' growth. For renters, this presents an opportunity to secure more competitive rates, while property owners may need to reevaluate pricing strategies or property differentiation to maintain market appeal.

-

Meanwhile, Semarang recorded rental price declines across all house types, following increases in the previous quarter. In contrast, Surabaya, Malang, and Sidoarjo showed stable rental prices this quarter.

-

Moving to Bali, Denpasar continues to experience rental price increases across all types (5% to 8%), sustaining momentum since 2024. This growth is driven by factors including strong tourism demand, expatriate activity, and domestic migration. For investors, Denpasar remains an attractive rental property location, particularly if tourism trends and infrastructure development continue to support growth.

-

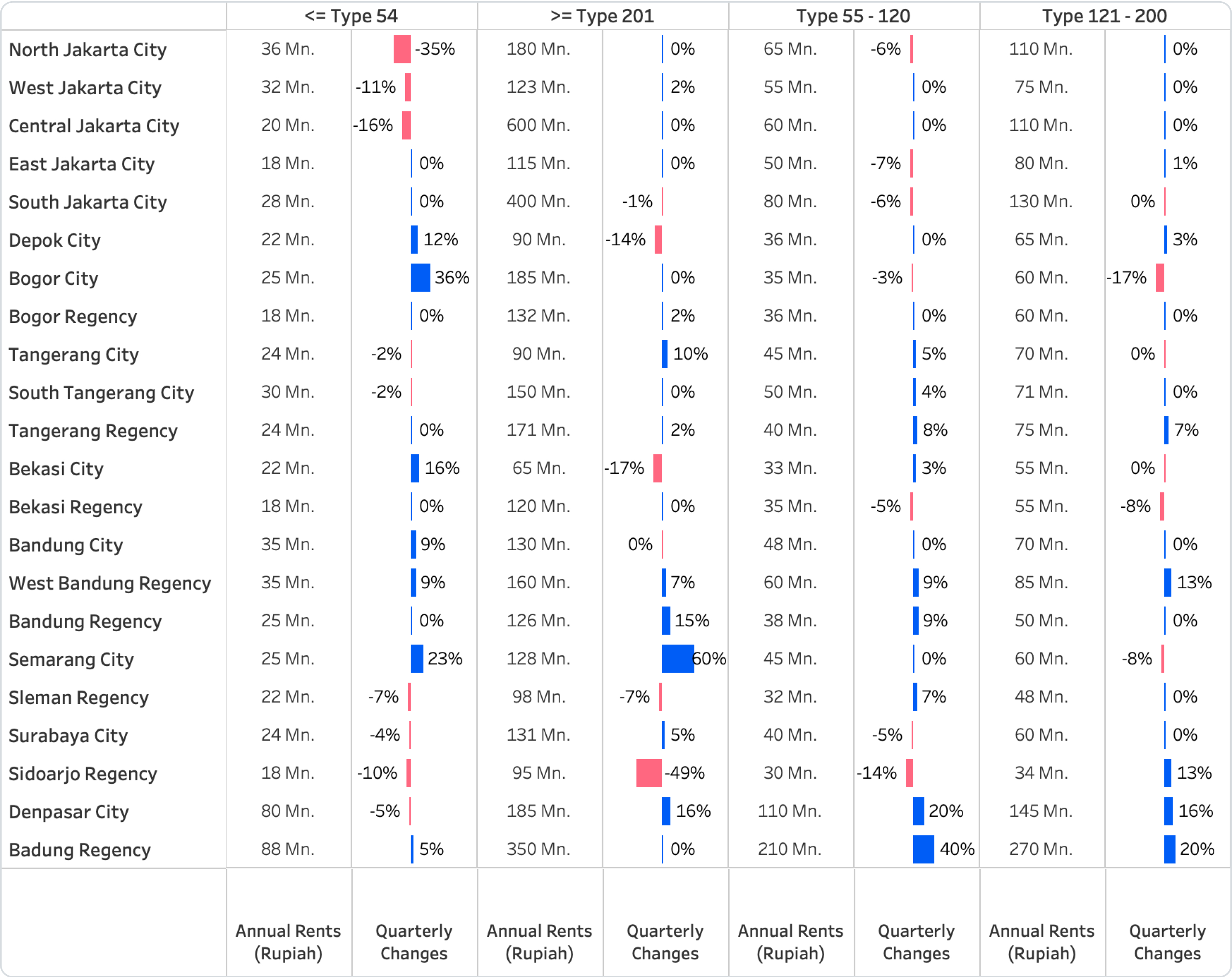

Homes less than or equal to type 54 in DKI Jakarta experienced a quarterly decreased in annual rent in North Jakarta (-35%), Central Jakarta (-16%), and West Jakarta (-11%). Meanwhile, annual rent prices have remained stable in East Jakarta and South Jakarta.

-

Conversely, in the cities of Depok, Bogor, and Bekasi, annual rental prices for homes with a size less than or equal to type 54 have increased on a quarterly basis. Meanwhile, annual rental prices in Bogor Regency and South Tangerang have remained stable across all home types.

-

In line with the increase in home values, homes with a type of 55 to 200 in Denpasar and Badung have experienced the highest quarterly increase in annual rental prices. Similarly, annual rental prices in West Bandung have increased across all home types.

-

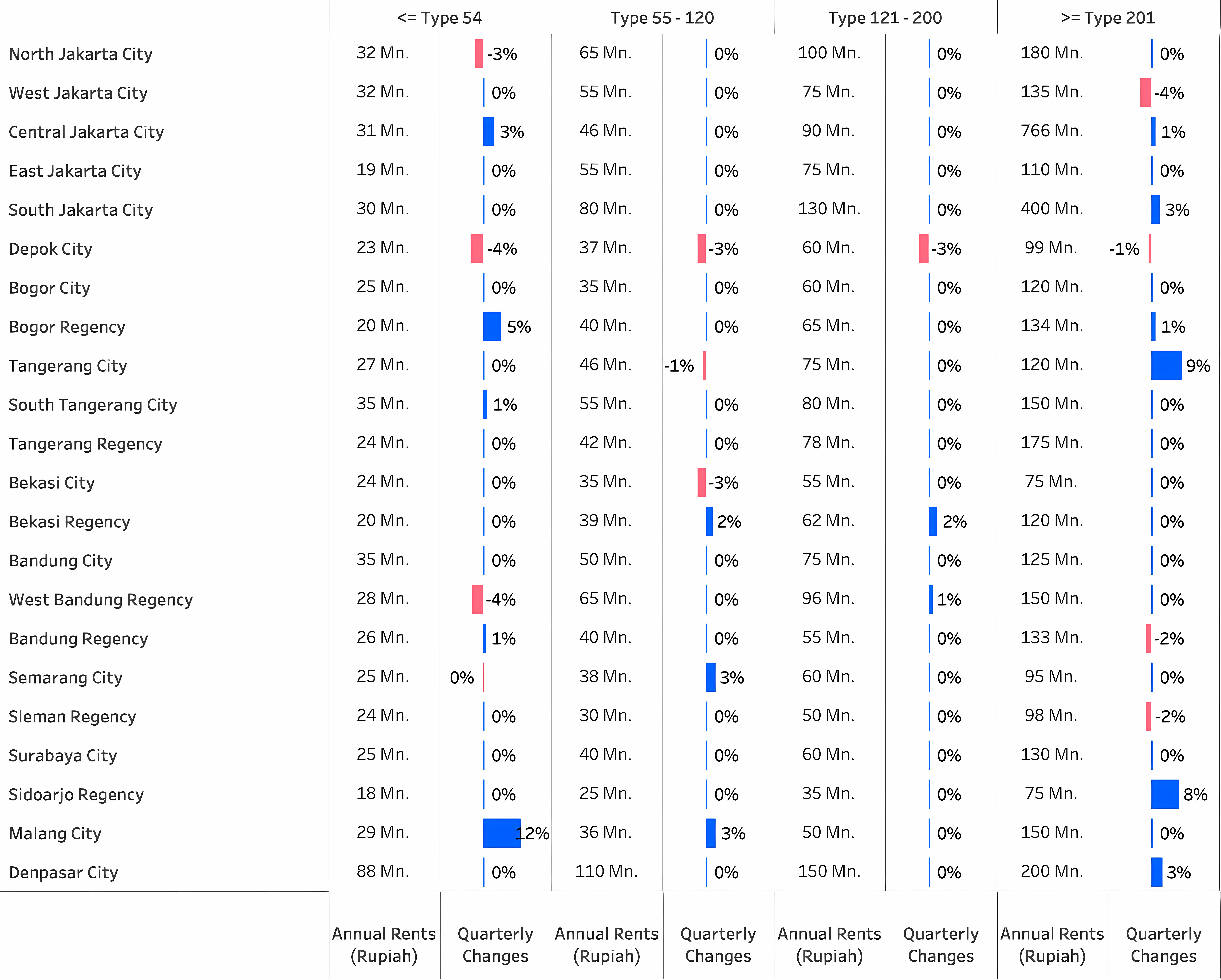

The rental market in Jakarta in the second quarter of 2025 shows dynamics in each house type.

-

A house with type <= 54 in North Jakarta experienced a slight correction of -3% quarterly. This decrease continues the decline from the previous quarter, due to a weakening demand for small-type house rentals there.

-

Houses with type 55-120 and 121-200 were stable across all Jakarta regions quarterly.

-

For a house with type >= 201, a decrease only occurred in West Jakarta (-4%), where the same house type had previously increased by 4% in the first quarter of 2025.

-

-

In the Bodetabek region, Depok was the only city with a rental price decrease across all house types. This is related to a surplus of listings meeting the academic holiday period. Meanwhile, in Tangerang City, a house with type >= 201 grew by 9% quarterly, reflecting the high residential demand in Greater Tangerang.

-

The rental market in Greater Bandung tends to be stable and is in a wait-and-see phase. The correction for a house with type <= 54 in West Bandung (-4%) continues the decline since the first quarter of 2025.

-

In Central Java, Sleman Regency was still able to maintain rental price stability, despite the semester holiday season, with a minimal correction only occurring in a house with type >= 201.

-

Continuing to East Java, Malang City experienced a surge in rental prices for a house with type >= 54, by 12% quarterly. On the other hand, a strong increase in Sidoarjo Regency (+8%) for a house with type >= 201. This shows a divergence of demand in Malang and Sidoarjo.

-

The annual house rental price increase for houses smaller than or equal to 54 in Jakarta occurred in Central Jakarta (52%) and East Jakarta (8%). Despite the significant rental price growth in Central Jakarta, the annual rental price since Q1 2024 has ranged between 20 million to 30 million rupiah per year. Conversely, the annual house rental price in South Jakarta has remained stable since Q2 2024.

-

For houses larger than 54 in Jakarta, annual rental prices have generally remained stable or decreased, with the most significant drop occurring in Central Jakarta, up to -18%.

-

In the Jakarta surrounding areas, aside from Depok City and Bogor City, houses smaller than or equal to 200 have experienced an increase in annual rental prices. The most notable increase occurred in South Tangerang City (20%), driven by a growing trend of house rental searches in Bintaro, South Tangerang, correlating with rising annual rental prices in the area. On the other hand, Bogor City saw the most significant annual rental price decrease for houses of type 121-200 (-17%) and type smaller than or equal to 54 (-6%). Furthermore, rental prices in Depok City remained stable in Q3 2024.

-

In Bandung City, Bandung Regency, and West Bandung, annual rental prices for houses smaller than or equal to 54 have generally declined, with the most significant decrease occurring in West Bandung Regency (-11%). However, overall, houses larger than 54 have seen an increase in annual rental prices.

-

In Central and East Java, annual rental prices for houses smaller than or equal to 54 have risen, led by Surabaya City with an increase of up to 8%. On the other hand, houses larger than 54 have experienced price fluctuations, with a general trend of declining annual rental prices. The most significant decrease was for houses larger than 201 in Semarang City (-20%), driven by rental price dynamics in Banyumanik district, which recorded the sharpest decline compared to other areas.

-

A similar trend occurred in Denpasar City, where annual rental prices for houses smaller than or equal to 54 increased by 4%. However, houses larger than 54 saw a decline, particularly for type 55-120 houses, which experienced a decrease of up to -9% in annual rental prices.

-

Annual house rental price in Jakarta tended to be stable to decline, particularly for houses smaller than or equal to 200.

-

House rental price for houses of type 121-200 in East Jakarta have declined again by up to -7% in this quarter, following a -6% decline in the previous quarter.

-

The most significant decrease, of up to -9%, occurred for the same type of houses in North Jakarta, where the annual rental price fell by 10 million.

-

-

House rent demand in Bodetabek is growing faster on a quarterly basis than Jakarta, leading to relatively higher annual house rental prices in Bogor, Depok, Tangerang, and Bekasi, particularly for houses smaller than or equal to 120. This provides an opportunity for property owners to maximize their income with higher rental prices. On the other hand, property renters may consider long-term rental as an opportunity to negotiate for lower prices.

-

In quarter 4 2024, house rental price in West Java, such as in Bogor, Depok, Bekasi, and Greater Bandung, tend to increase for houses smaller than or equal to 120, while house selling price trends remain relatively stable.

-

Annual house rental price for houses of type 55-120 in Semarang City, Sidoarjo Regency, and Malang City are declining, with the most significant decrease of 3 million per year occurring in Semarang City.

-

Meanwhile, annual house rental price remain stable in Surabaya and Denpasar City.

SHARE TO